BRIEF FROM VANCOUVER AIRPORT AUTHORITY

Executive Summary

The Vancouver Airport Authority is pleased to present its submission to the Annual Pre-budget Consultation process. We believe approval for an Arrivals Duty Free pilot program and a Foreign Trade Zone policy will assist the Federal Government in their mandate to achieve sustained economic recovery and create quality sustainable jobs by improving the competitiveness of Canadian gateways and communities. Both programs repatriate economic activity that is currently transpiring abroad back to Canada, resulting in increased revenues to the Federal and Provincial governments and the local economy.

Arrivals Duty Free

Introduction of Arrivals Duty Free (ADF) would permit the sale of duty free items to passengers deplaning at Vancouver International Airport (YVR) from an international originating point. The key benefits are threefold:

· Repatriation sales to Canada that are currently happening overseas.

· Improvement for passenger convenience while reducing airline weight and fuel-burn.

· Positive economic impact to Canada and B.C. with no loss for domestic businesses.

Presently, federal duty-free related laws, regulations, and policies do not permit the introduction of ADF at Canadian airports by specifically limiting Duty Free sales to passengers leaving Canada. Finance Canada held consultations in May, 2009 with overwhelming support including tourism groups, communities, airlines and airports.

Context

The global financial crisis has had an unprecedented impact on the aviation industry.

Previous world events (e.g., Gulf War and Recession; 9/11 and SARS; etc.) have had as negative effect as the recent economic downturn and H1N1 Flu. For Vancouver International Airport, the number of international enplaned/deplaned passengers dropped by over 12% from 2008 to 2009. We hope that the volumes should recover by 2012/13. However, with new financial crisis, there are no guarantees.

Background

Since 9/11, airports and duty free operators have met and exceeded all security requirements, while trying to minimize the negative effects on passenger convenience and retail sales. Repeated security threats have hit duty-free sales and will continue to do so. Enhanced security measures resulting from the terror plot in London, UK in August 2006 have restricted the sale and transportation of gels and liquids.

The inability to operate Arrivals Duty Free (ADF) creates a competitive disadvantage for major airports in Canada due to the loss of sales to passengers occurring in other countries. With a growing number of airports around the world implementing both arrivals and departures duty free operations, Canada stands to lose further ground in airport duty free sales and employment. ADF is a rapidly growing trend around the world. Currently, over fifty-five countries have implemented duty free stores in the international arrivals area of an airport with Switzerland, in 2011, being the most recent. The result is less Duty Free goods being purchased on departure from Canadian airports due to the availability of Arrivals Duty Free in destination country.

Arrivals Duty Free Concept

In professional surveys conducted in 2008 at four of Canada’s major international airports, 46% of passengers arriving to Canada have stated they would be likely to purchase from duty free upon arrival in Canada.

From the real commercial uptake experienced in Australia after they introduced an ADF regime, it is estimated that Canada could reasonably expect an increase of 35% in sales or $60 million in ADF purchases repatriated to Canada that currently take place upon departures at foreign airports. This translates to over $15 million annually in British Columbia alone.

Additionally, a 2009 study demonstrated that the cost to local businesses would be negligible as evidenced by tax revenue neutrality in other jurisdictions that have implemented ADF (e.g. Hong Kong and Australia). Economic impact analysis suggests that over a five-year period, incremental ADF sales would be approximately $395 million across Canada. A study quantified the immediate economic benefits in Canada as:

· 400 new jobs (approximately 108 in B.C.)

· $71 million in wages (approximately $18 million in B.C.)

· $21 million in federal revenues (approximately ~$1 million to B.C.)

Switzerland opened its first ADF store on 1 June 2011 after concluding that it would benefit generate approximately $50 million CDN in annual sales, over 50 new jobs, provide a competitive advantage over neighbouring European airports and would not impact the local retailers. There are now ADF stores across several airports in Switzerland. Travellers to Switzerland are also able to select their ADF items at foreign point of departure and quickly collect them upon arrival to Switzerland. Initially offered at Geneva and Zurich airports, the ADF stores have already expanded to Basel; with further growth planned at these locations.

Changes Required for Arrivals Duty Free in Canada

There are four changes needed to introduce Arrivals Duty Free to Canada. Due to the nature of the definition of duty free applied to departures only, whether a “pilot project” or full ADF is sought, changes would be required.

1. Customs Act |

The Customs Act is currently being revisited for other issues, so now would be a good time to introduce this change. |

The federal Customs Act Section 24(1) would have to be amended to include duty free sales to include arrivals to Canada. |

|

(c) as a duty free shop for the sale of goods free of certain duties or taxes levied on goods under the Customs Tariff, the Excise Act, the Excise Act, 2001, the Excise Tax Act, the Special Import Measures Act or any other law relating to customs, to persons who are about to leave Canada |

|

2. Duty Free Shop Regulations |

Duty Free Shop regulations are under review as well. |

Duty Free Shops Regulations Section 18(1) also require corresponding changes to cover those persons who are about to enter Canada. |

|

the ownership of goods in a duty free shop may be transferred only by sale to persons who are about to leave Canada. |

|

3. Finance Policies |

|

Although specific Finance Canada policies do not prohibit ADF, their general tax policies and principles hold that goods sold for consumption in Canada cannot be tax/duty exempt. This policy would need to be revised for the definition of duty free to allow for ADF. |

|

4. Customs Controlled Area Regulations |

CCA legislation was passed in 2009 and Regulations should be completed in early 2012. |

Canada Border Services Agency has jurisdiction over the sterility of passenger processing upon entry to Canada. The Agency has long been concerned about the potential for conspiracies with retail operations and so CBSA has indicated they would approve Arrivals Duty Free only if Customs Controlled Area power were in place. |

Support

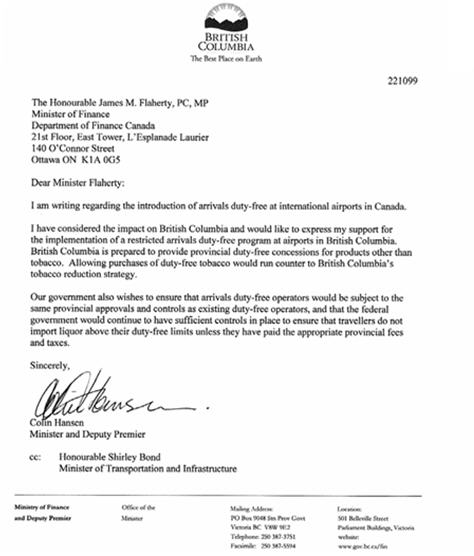

In addition to such groups as the Vancouver Board of Trade, Retail BC and the Canadian Chamber of Commerce, the Minister of State for Intergovernmental Relations previously expressed general support initiatives such as Arrivals Duty Free that can support YVR’s role to develop international trade, travel and tourism. In addition, the Minister of Finance and Deputy Premier has indicated support as evidenced by the following letter of support.

Foreign Trade Zones

Over the past several years, Canada has invested heavily in infrastructure at its international Gateways. It has also reduced tariffs on some manufacturing equipment and inputs, and committed to the elimination of these tariffs by 2015. These are significant actions that enhance Canada’s competitive position and will help attract to Canada manufacturing and other economic activity that currently take place elsewhere.

A key element in the competitiveness agenda that has not been fully addressed in Canada is Foreign Trade Zone (FTZ) policy. While Canada has a number of programs in place that provide benefits similar in part to those available in Foreign Trade Zones in other countries, there are limitations that prevent the full range of potential economic activity that could take place in a true Canadian FTZ.

Background

An FTZ is a designated area in or near a Customs port of entry, where foreign and domestic merchandise is considered to be outside the Customs territory of the nation. As a result, certain types of merchandise can be imported into a FTZ without going through formal Customs entry procedures or paying import duties. Customs duties and excise taxes are due only if and when the goods leave the FTZ and enter the domestic economy. If the goods are exported from the FTZ, then no duties or taxes are due.

Activities that are allowable inside the FTZ include assembly, testing, packaging, processing, and manufacturing.

While FTZs remain outside the national customs area, they are otherwise part of the host nation and all laws are applicable, including those related to environment, immigration, health and labour. Tax laws continue to apply, other than deferral of duty and HST/GST until goods enter domestic commerce. The budget tabled in the House of Commons on 6 June 2011 included a commitment to revisit Canadian FTZ policy to ensure it is competitive.

Changes Required to Support Effective FTZs in Canada

There are four types of issues related to the Canadian programs that need to be addressed in order to establish effective FTZs. The four are; limitations on the proportion of goods that can be sold in Canada; limitations on value added; the inability to defer GST/HST; and program administration and marketing.

1. Limitations on goods that can be sold into the Canadian market

In pursuing export markets and limiting the opportunity for Canadian firms to take advantage of duty deferral on domestic sales (presumably with the intent of protecting existing manufacturers, though analysis of potential impacts does not appear to be publically available), Canada’s programs limit the potential for substantial investment and economic activity in Canada. Relaxing the current limits on Canadian sales (30% for duty deferral, 10% for an Export Distribution Centre, or EDC) would encourage greater investment and create additional jobs and government revenues in Canada. Arguably, if as much as 50 or 60% (for example) of goods could be sold into the Canadian market, Canada would still benefit from significant export volumes, and the competitiveness of goods sold into the Canadian market would be enhanced relative to offshore production. Given the potential export volumes and the high proportion of goods sold in Canada that are manufactured entirely offshore, the net benefit could be significant.

2. Value Added

There are significant limitations on value added within the EDC program and in aspects of the duty relief program (essentially, goods must be exported without substantial change), and financial limits on expenditures to process the goods are imposed in the EDC program. Raising these limits would again create the potential for additional export and domestic sales and increase employment in Canada.

3. Deferral of GST/HST

While deferral of GST/HST is permitted in some programs, it is not permitted in the Duty Relief Program. With the implementation of HST in Ontario and British Columbia, the benefit arising from deferring this tax would be significant. As with other proposed changes, this would improve Canada’s competitiveness in export markets.

4. Program Administration and Marketing

One of the significant operational advantages of the US FTZ program is the provision of an “operator”, who will act as a single point of contact for potential and current users of the FTZ, providing liaison and reporting to US government agencies. The operator also undertakes marketing of the FTZ with potential users. Provision for such an “operator” would be a useful enhancement to the Canadian FTZ-like programs, which are based in different government departments, are not transparent, and require a potential user to understand program content and decide which programs may be applicable under what circumstances.

A significant step forward in this area is CentrePort, which could serve as a model for application across Canada. There may be significant merit, however, in a broader model.

Local agencies could be created or existing agencies identified to designate an area as a “Foreign Trade Zone”, with the support of the province in which they operate. The local agencies would provide financial support, which the Province and the Department of Foreign Affairs and Trade (DFAIT) would match. DFAIT and the province would provide marketing materials on Canada’s FTZ-like programs and other advantages of doing business in Canada. The Agency would serve as a central marketer/point of contact/advisor on relevant federal and provincial programs, work with stakeholders on development opportunities and issues; and liaise with local businesses, agencies, and municipalities (ports, airports, economic development offices, and permitting agencies).

Support

A broadly based FTZ Coalition has been formed by key stakeholders that support the development of FTZs in Canada to enhance our gateway opportunities and foster economic activity in Canada. The Coalition includes; Aéroports de Montréal, CN, Centre Port Canada, Canadian Pacific, Greater Toronto Airports Authority, Global Container Terminals, Greater Vancouver Gateway Council, Port of Halifax, Port Metro Vancouver, Prince Rupert Port Authority, Winnipeg Airports Authority and the Vancouver Airport Authority.

Key Recommendations:

1. Undertake an Arrivals Duty Free pilot program at Vancouver International Airport.

2. Eliminate the restrictive provisions of existing Canadian “FTZs” policies to enable the creation of true FTZs in Canada.

3. Actively support the marketing of FTZs to prospective users.